An Overview of Last Year’s Federal Court Rulings

In the past year (2024), the Swiss Federal Court issued several rulings on money laundering and financial offenses, emphasizing important aspects of the due diligence obligations of banks and financial intermediaries.

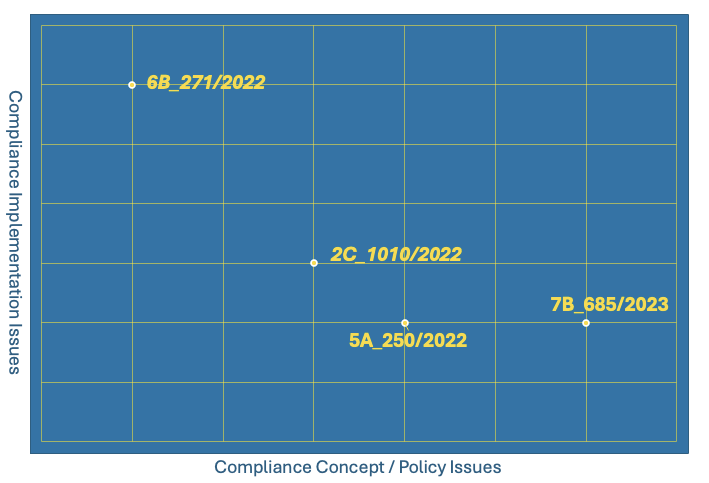

In the first ruling (6B_271/2022), the court clarified that banks share responsibility for the verification of the identity and source of funds of their clients. In another case (7B_685/2023), it was emphasized that a violation of the Anti-Money Laundering Act (AMLA) can be established if the necessary FINMA license is not obtained, as this would constitute a breach of registration and licensing requirements. A further important ruling (2C_1010/2022) confirmed that banks are entitled to identify beneficial owners and share their information in the context of international mutual legal assistance. Finally, it was decided (5A_250/2022) that a notice of garnishment does not serve as a basis for assuming a money laundering risk.

Compliance Implementation Issues vs Compliance Concept and Policy Issues

This graphic illustrates not only that the compliance concept or policy must meet the requirements, but also that it must be successfully implemented in order to prevent legal consequences.